Holiday Home Uk Stamp Duty

If you're thinking of buying a holiday let, there are some additional charges that must be factored into your costs – Stamp Duty is one of these.

Read on to discover all you need to know about Stamp Duty for holiday lets.

What is Stamp Duty?

Higher Rates Stamp Duty

How to pay Stamp Duty

Am I eligible for a Stamp Duty refund?

Land and Building Transaction Tax (LBTT) in Scotland

Land Transaction Tax (LTT) in Wales

What is Stamp Duty?

Stamp Duty Land Tax (SDLT) is a tax you'll have to pay if you buy a residential property or piece of land that costs more than £125,000 in England or Northern Ireland.

During the COVID-19 pandemic, the UK government announced temporary reduced rates for Stamp Duty, however this scheme is now closed.

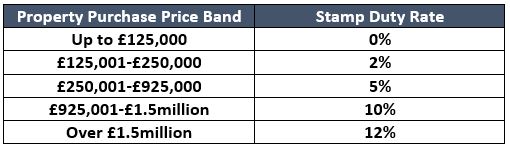

Stamp Duty is calculated on a tiered basis – you are taxed on the part of the property purchase price that falls into each Stamp Duty threshold. For example, if you buy a property worth £290,000, the tax would be calculated as 0% on the first £125,000, 2% on the next £125,000, and 5% on the final £40,000. So £0 + £2,500 + £2,000 = £4,500.

Stamp Duty Tax rates:

If you're buying a property in Scotland, you'll pay a tax called Land and Buildings Transaction Tax (LBTT) instead of Stamp Duty. In Wales, you'll pay Land Transaction Tax (LTT). You can read more on these below.

If you're buying a second home or buy-to-let property, you'll have to pay an extra charge on top of the normal Stamp Duty rates in a tax that HMRC calls Higher Rates on Additional Dwellings (HRAD).

Higher Rates Stamp Duty

If you're buying an additional residential property to the one you call home, including holiday lets, you will pay the higher rates of Stamp Duty. These apply:

- If the residential property you're buying is worth £40,000 or more, and you already own a property worth £40,000 or more

- On additional properties that you part own, so long as your share is worth £40,000 or more

- If you own a property abroad and are looking to buy an additional property in the UK worth more than £40,000

- If you're married or in a civil partnership, the rules apply as if you are buying the property together, even if you're not. So, if your spouse has to pay the higher rates, you'll have to pay them

Stamp Duty higher rates don't apply if:

- The property is worth less than £40,000

- The property is moveable – e.g. caravans, houseboats or mobile homes

How much is Stamp Duty on holiday lets?

As buying a holiday let falls into the criteria for higher rates Stamp Duty, you will have to pay an additional 3% of your property purchase price. Higher rates Stamp Duty works as a slab tax, as opposed to standard Stamp Duty that is applied on a tiered basis.

Example: If you bought a property worth £400,000 when standard Stamp Duty rates apply, you'd pay £10,000 in standard Stamp Duty charges. This breaks down as: 0% £0 for the first £125,000, 2% (£2,500) for the next £125,000, and 5% (£7,500) for the final £150,000. You would also pay an extra 3% of the overall price (£12,000) for the extra higher rate Stamp Duty charge, making the overall charge £22,000.

You can always use an online Stamp Duty Calculator to work out a rough estimate of what you might have to pay.

Am I exempt from the higher rates of Stamp Duty Landing Tax?

There are some cases where you could be exempt from the higher rates of Stamp Duty as a holiday home owner. These include:

There are some cases where you could be exempt from the higher rates of Stamp Duty as a holiday home owner. These include:

- If you buy a property with an annexe or an additional dwelling in the grounds (for example, a "granny flat"). You won't have to pay the tax on this as a second home, so long as the main property is worth at least two thirds of the overall property price

- If you buy a plot of land without a property already on it (even if you plan to build a property on it at a later date), you won't have to pay the higher rate

- If you buy a mixed-use property as your additional property (e.g. a restaurant, shop or office with a flat above), you will be exempt

If you are unsure, get some financial advice on second home Stamp Duty exemptions before you buy.

How do I offset the cost of the higher rates of Stamp Duty?

These higher rates may make you think twice about buying a buy-to-let property, but if you set up a successful holiday let, you may be able to earn your investment back by renting it out throughout the year. You will also have the bonus of having a property you can use for getaways with family and friends.

If you're setting up a Furnished Holiday Let, you may also be able to claim certain tax benefits, such as deducting the cost of the furnishings from your pre-tax profits, and making tax-advantaged pension contributions. Read more about these and other advantages in our article furnished holiday let tax guide.

How to pay Stamp Duty Land Tax

You have 30 days from your completion date to pay any Stamp Duty that you owe, and to file a return to HMRC.

Usually, your solicitor will help with this. They will usually calculate the amount, collect it from you and pay it on the day of your completion, as well as submitting your return.

Am I eligible for a Stamp Duty refund?

If you sell what was classed as your main home within three years of buying your additional property, you can apply for a refund on the higher rate of your Stamp Duty bill – so long as neither you or your spouse still own any part of your previous home or fall under the rules for another reason.

To do this, you can use HMRC's online form paying attention to the time frames set out.

Land and Building Transaction Tax (LBTT) in Scotland

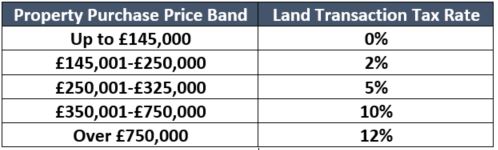

Scotland and Wales have slightly different tax rules and thresholds for the tiered charges applied in England and Northern Ireland, but both also apply higher rates for second homes.

In Scotland, you must pay Land and Buildings Transaction Tax (LBTT) when you buy residential property worth more than £145,000 – this is done on a tiered basis, requiring payment per each part of the purchase price in each threshold.

Announced in the 2021-22 Scottish Budget, the Land and Building Transaction Tax rates are below:

Land Transaction Tax (LTT) in Wales

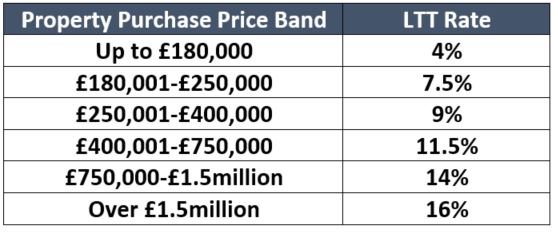

In Wales, when you buy residential property worth £180,000 or more, you'll have to pay Land Transaction Tax (LTT). Again, this is calculated on a tiered basis based on different property price bands. If you're buying an additional residential property worth more than £40,000, you'll also have to pay an extra 4% on top of the standard LTT.

The Welsh government have introduced a Land Transaction Tax holiday as a result of the pandemic, and on March 3rd 2021, an extension of this relief was announced, meaning that it will be in effect until June 30th 2021.

The announcement stated that you will not have to pay LTT on properties bought for up to the value of £250,000 before July 1st 2021. From this date onwards, this value will return to £180,000, there will be no transitional period for these rates.

Higher rates of Land Transaction Tax

Similarly to England, buying a holiday let in Wales would require you to pay higher rate of LTT.

Standard Land Transaction Tax rates (applicable from July 1st 2021)

* At the time of publishing (24th June 2021), Sykes Holiday Cottages has taken all reasonable care to ensure that the information contained in this article is accurate. However, no warranty or representation is given that the information is complete or free from errors or inaccuracies. Generic information is contained within this article and each individual's financial affairs are different, further advice should be sought from a financial advisor.

Download your free owner pack today

Find out how we can work together. With over 30 years' experience, have confidence in our expert knowledge and hassle-free holiday letting service to drive the success that you deserve as cottage owners.

mcclearyroonstank.blogspot.com

Source: https://www.sykescottages.co.uk/blog/a-quick-guide-to-stamp-duty/

0 Response to "Holiday Home Uk Stamp Duty"

Post a Comment